Saving Rural Rental Homes

The numbers of RD rental housing units and developments have steadily decreased primarily because of RD loan prepayments, mortgage maturities, and foreclosures. The RD Voucher Program makes vouchers available to persons threatened with displacement due to prepayment or foreclosure of an RD rental housing loan.

NHLP has drafted this advocacy guide about Rural Development rural rental housing preservation, which focuses on saving affordable rural homes and protecting residents against rent increases and displacement. Specifically, this guide is designed to assist legal services attorneys and tenant advocates in understanding and preventing mortgage prepayments, mortgage maturities, and foreclosures in U.S. Department of Agriculture RD properties. The guide contains important information about key RD housing programs, the main threats challenging the long-term affordability of rural affordable homes, how to identify these threats in your own community, important tenant rights and protections, and litigation and strategy issues to consider. For additional assistance, please contact Natalie Maxwell (nmaxwell@nhlp.org) or Marcos Segura (msegura@nhlp.org).

Prepayment of RD Loans

Loan prepayments were rare until 1974 because mission-driven organizations, such as nonprofit and public agencies, were the only borrowers that could secure subsidized loans and they had no reason to prepay the loans. Private for-profit persons and entities could only secure unsubsidized RD market-rate loans and, therefore, had no incentive to refinance the loans with a private market-rate loan because the interest rate differential was small.

In 1974, however, RD opened up the subsidized Section 515 rental loan program to private limited-profit owners and developers by changing one of the loan eligibility requirements. Specifically, it altered the requirement that private borrowers who operated on a limited-profit basis could not secure a subsidized RD loan unless they could not qualify for a private loan. The revised regulations allowed them to secure an RD loan if they could show that they would not qualify for a loan that would enable them to serve low- and moderate-income households. This allowed all private applicants to qualify for subsidized loans.

What the agency failed to do at that time is to limit the owners’ ability to refinance and prepay their loans unless they could show that they could and would continue to serve low and moderate income households after the prepayment. This would have limited private borrowers from leaving the program. Unfortunately, as a result of the new regulations, private borrowers could enter and leave the program at will and, upon prepayment, displace the residents due to the loss of the RD subsidies.

When Congress became aware of the problem in 1979, it required all borrowers whose loans were approved after December 21, 1979 to agree to maintain the housing as affordable housing for a term of 20 years. This stopped prepayments of new developments but did not stop owners of developments that were financed prior to 1979 from prepaying their loans. As prepayment of pre-1979 loans and resident displacement increased in the mid-1980s, Congress placed a moratorium on prepayments in 1986. The moratorium stayed in place unit 1988 when Congress enacted the Emergency Low Income Housing Preservation Act of 1987 (ELIHPA), which restricted prepayments of all 514 and 515 loans financed prior to 1987.

In 1989, Congress extended owners’ obligation to maintain the housing as affordable housing for the term of the RD loan and, in 1991, it extended the ELIHPA use restrictions to all developments financed between 1979 and 1989.

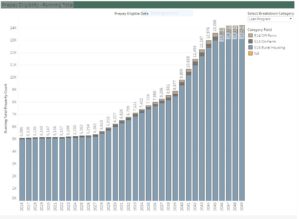

The following chart shows the number of properties that are eligible for prepayment by year.

Note: Section 515 Rental Housing and Section 514/516 farm labor housing owners had no obligation to keep the housing as affordable housing for any period of time during the first 17 years of the programs’ operation. Borrowers could secure an RD loan and pay it off at any time after construction was complete.

Sources of information on RD Prepayments

The RD regulations governing prepayments are set out at 7 C.F.R. Part 3560, Subpart N. Chapter 15 of RD Handbook 3-3560 also provides guidance on RD prepayments.

Persons working for nonprofit or public entities who want to receive weekly emails of recently filed and pending prepayments in their state or other states, can sign up at the Preservation Information Exchange (PIX).

RD also maintains a downloadable Excel file that shows when various use restrictions expire on individual properties. Other information is available in this spreadsheet including the name of the owner, units of various sizes in the development, the number of units assisted with Rental Assistance and whether the property is eligible for prepayment. The file can be downloaded from. The same information can also be accessed in a different form at https://www.policymap.com/maps.

Very brief information about Section 515 developments can also be accessed and searched at htttps://rdmfhrentals.sc.egov.usda.gov/

The ELIHPA Prepayment Process

In a RD prepayment, the owner must apply to RD to prepay the loan. If the request is complete, RD must notify the residents of the request within 30 days of its receipt. RD must offer incentives to the owner in an effort to keep the owner in the program. If the owner accepts the incentives, then the development will stay in the program for an additional 20 years.

Owners who reject the incentives have two options:

- Agree to offer to sell the development to a nonprofit or public entity for a period of 6 months. If a good faith purchase offer is made, the owner must accept the offer and give the buyer up to 2 years to close the deal. RD financing is available to the purchaser to purchase the development. Other financing must typically be secured to rehabilitate and upgrade the development. If no purchase offer is made or the deal is not closed, the owner may prepay the loan without any restrictions.

- Have RD determine whether the prepayment is precluded because it will have a material impact on minority housing opportunities, in which case the owner must offer the development for sale to a nonprofit or public entity for a period of 180 days.If the prepayment will not have a material impact on minority housing opportunities, RD must determine whether there is adequate affordable housing in the community to which the residents can move upon prepayment. If there is no such housing, the owner may only prepay the loan subject to use restrictions that are intended to protect residents in the development against displacement for as long as they seek to live there. If there is such housing, the owner can prepay without use restrictions.

Cases

Franconia v. United States, 536 U.S. 129 (2002)

The Supreme Court held that ELIHPA was a compensable taking under the Fifth Amendment. RD has paid owners hundreds of millions of dollars as a result of the decision. However, it has required owners who received damage funds to remain in the Section 515 program for an additional 20 years.

Goldammer v. United States, 465 F.3d 1031 (9th Cir. 2006).

Reversing a lower court decision, court held that residents of Section 515 development are entitled to judicial review of RD decision to approve prepayment of Section 515 loan. Without an explicit statement, the court effectively reversed a prior 9th Circuit Decision, which held that, ELIHPA notwithstanding, owners of Section 515 development are entitled to prepay their loan through a state quiet title action. Kimberly Assoc. v. United States, 261 F.3d 864 (9th Cir. 2001).

Parkridge Investors Ltd. v. Farmers Home Administration, 13 F.3d 1192 (8th Cir. 1994)

The court held that application of ELIHPA to Parkridge’s loan agreements did not violate the partnership’s substantive due process rights and that it did not result in a compensable taking under the Fifth Amendment. Accordingly, the court of appeals upheld ELIHPA’s constitutionality.

Owens v. Charleston Housing Authority, 336 F. Supp. 2d 934 (E.D. Mo. 2004)

The court held that the housing authority owner of a Section 515 development could not prepay its loan even when it owed less than $200 and that its efforts to vacate and demolish the development violated the Fair Housing Act. Affirmed, Charleston Housing Authority v. U.S. Department of Agriculture, 419 F.3d 729 (8th Cir 2005) (in light of ELIHPA, the housing authority was not entitled to quiet title to the property when it proffered to pay the balance of the loan).

Lifgren v. Yeutter, 767 F.Supp. 1473 (D. Minn. 1991)

Residents of a prepaid Section 515 development, subsidized by HUD Section 8 project-based subsidies, challenged the prepayment of a 515 loan because RD failed to make an incentive offer to the owner prior to approving the prepayment offer and to include proper use restrictions in the release deed at the time of loan satisfaction. The court found that the prepayment violated ELIHPA and the development was returned to RD’s inventory.

- Two unreported cases similar to Lifgren were settled by RD shortly after Lifgren was decided. Clark v. Madigan, 85 CV 73427 (D. Mich. May 21, 1991) (Consent Decree) and Meehan v. Madigan, C-91-1472R (W. D. Wash. Sept. 30, 1992) (Consent Decree).

Goldammer v. Veneman, 2007 WL 1748665 (D. Or. June 14, 2007).

The court, upon remand, held that RD accepted the prepayment of the Section 515 loan in violation of ELIHPA and that the development had to be brought back into the 515 program.

Schroeder v. United States, 2007 WL 3028432 (D. Or. October 16, 2007).

The court held that ELIHPA precludes owner of a Section 515 development from prepaying the Section 515 loan as part of an action to quiet title to the property even though owner has proffered to pay the balance of loan. Affirmed Schroeder v. United States, No. 07-36073 (9th Cir. June 22, 2009) (any final payment made before the loan due date in the promissory note is a prepayment which must be processed in accordance with ELIHPA and RD regulations implementing the statute).

Mortgage Maturities

In September 2022, NHLP submitted testimony for the record to the Banking, Housing and Community Affairs Subcommittee on Housing, Transportation, and Community Development for the Congressional hearing titled, “Examining the U.S. Department of Agriculture’s Rural Housing Service: Stakeholder Perspectives.” The testimony focused on actions that USDA’s Rural Housing Service must take to protect the rights and interests of low-income borrowers and tenants and to preserve its multifamily housing programs. You can read NHLP’s written testimony here: NHLP Congressional Testimony on Stakeholder Perspectives.

RD Section 515 loans have been made for a variety of terms. In the 1960, when loans were restricted to elderly housing, loans were typically made for a term of 50 years. When the program was extended to family households, loans for family housing were typically made for 40 years while loans for elderly housing continued to be made for 50 years. Section 515 loan terms were reduced by RD to 30 years with a 20-year RD renewal option after Congress, in 1989, extended use restrictions to the full term of the loan.

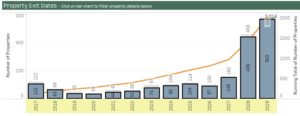

More than 40 years have passed since the first family housing loans were made in the 1960s and 50 years have passed since some of the first elderly housing loans were made. As a result, Section 515 developments have been maturing since about 2003. The number of developments with maturing mortgages has been accelerating since although they remain in a relatively modest range. RD predicts that loan maturities will accelerate over the next 10 years and will increase dramatically as of 2028.

RD has made little effort to deal with maturing loans and Congress has criticized the agency for failing to propose ways to limit mortgage maturities and protect residents from displacement. The only formal action that it has taken was the publication of an Unnumbered Letter (UL) in April of 2015, which was renewed and extended in December 2016.

The UL sets out various options for handling maturing loan properties. First, it makes clear that all loans that are nearing pay off prior to the original loan maturity dates are considered prepayments and must be processed in accordance with the RD prepayment regulations. Loans may be ahead of schedule for a variety of reasons including, failure to use all the original loan proceeds, supplemental principal payments, erroneous amortization schedules, and sale of a portion of the secured property the proceeds of which were paid to RD. Loans that are ahead of schedule cannot be allowed to prepay without the owner having filed a prepayment application and any payment that is received by RD that would pay off the loan must be returned.

RD’s servicing agents are urged to notify borrowers with loans that are 36 or fewer months before loan maturation when the loan will mature, that RD subsidies will terminate as of the maturity date, and the options that the borrower has to reamortize the loan balance, thereby continuing the subsidies. RD staff is urged to encourage borrowers with loans scheduled to mature before the end of 2019 to request loan deferral under the Multifamily Preservation and Revitalization (MPR) Demonstration program. Those who decline to do so are encouraged to apply to prepay their loan, thereby making the residents eligible for RD Vouchers if the loan is prepaid before the maturity date. In the alternative, they can apply for incentives to avert prepayment.

RD has implemented a “Re-am-Lite” processing system under the UL to ensure that RD can reamortize loans quickly when owners have requested reamortization of loan balances.

RD also encourages owners to notify residents of the impending loan maturity be sending a letter to the residents that is set out in the UL.

RD has not articulated any other policy to deal with maturing loans. In 2016, it requested that Congress make RD vouchers available to residents of maturing loans, but the agency has not pursued that option vigorously. It has also not articulated any way in which the loss of the Section 515 rental housing can be ameliorated through a permanent voucher system or the decoupling of RD subsidies from its Section 515 mortgage program. As a consequence, RD loans will continue to mature, residents will be displaced and the Section 515 program will effectively end before 2050 leaving rural communities and residents without affordable housing.

Mortgage Foreclosures

Mortgage foreclosures are another way in which the RD rental housing stock is being diminished. RD will frequently foreclose on borrowers who have defaulted on their loans by either failing to make payments, not maintaining the RD-financed housing, and not responding to RD efforts to operate the housing in accordance with program policies. RD foreclosures are most frequently carried out in a manner that ensures that the property leaves the Section 515 program and relieves RD from continuing to have any responsibility for a development’s operations. RD accomplishes this by bidding less than the property’s fair market value at the foreclosure sale and thereby encouraging purchaser who do not intend to keep the housing in the RD programs to bid at the foreclosure sale. RD has the authority to compel current owners to abide by their loan obligations by bringing a specific performance law suit against the owner or forcing the development into receivership. These options are, however, rarely used.

RD’s obligations to residents throughout the foreclosure process are set out in Chapters 6 and 15 of RD Handbook 3-3560. RD frequently does not follow those obligations strictly. See, Turner v. Vilsack, 2013 WL 6074114 (D. Or. Oct. 24, 2013).

Residents of developments that are foreclosed upon are eligible for RD vouchers. When foreclosures are for reasons other than monetary default, residents with RD vouchers may have to move to other housing if the existing development does not meet health and safety standards.

RD Vouchers and Letters of Priority Entitlement (LOPES)

RD has statutory authority under Section 542 of the Housing Act of 1949 to operate a voucher program in rural areas that is comparable to the HUD Housing Choice Voucher program. That voucher program has, however, never been funded. Instead, Congress has authorized RD to operate a more stringent voucher program through annual appropriations bills since 2006. That program limits vouchers to residents in developments that are prepaid or foreclosed upon and restricts the subsidy that residents are eligible to receive to the difference between the market value of their unit as of the date of prepayment or foreclosure and the rent that the resident was paying. The appropriations acts have never authorized RD to increase the voucher subsidy when rents increase, when household income decreases, or when a voucher holder moves to another community where rental prices are higher.

RD has operated the voucher program for 11 years without publishing formal regulations that were subject to public notice and comment. Instead, the agency publishes an annual notice in the Federal Register that sets out the manner in which RD operates the program.

There are several issues that arise from the manner in which RD operates its voucher program. First, it does not allow residents to apply for vouchers prior to loan prepayment or foreclosure and requires borrowers to live in the prepaid or foreclosed property as of the date of prepayment. The latter requirement is mandated by statute, the former is not. The RD regulations restrict retroactive voucher payments to 60 days prior to RD having entered into a Housing Assistance Payment (HAP) Contract with the owner of the development in which the resident wants to use the voucher. The fact that the resident cannot apply for a voucher until after the prepayment has occurred together with the 60-day retroactive limitation causes many households eligible for vouchers to have to pay full market rent when RD is unable to promptly inspect the unit and distribute voucher payments within the 60-day limitation.

Second, RD requires that all adult residents of households applying for vouchers be citizens of the United States or persons admitted for permanent residence. While a citizenship requirement is mandated by Section 214 of the Housing and Community Development Act of 2008, that Act does not require all household residents to meet that requirement. In the case of mixed households, it authorizes proration of the voucher subsidy. Indeed, HUD has allowed minor household members to qualify the entire household to live in HUD subsidized housing or to receive HUD vouchers, provided the subsidy is prorated. RD has not implemented the proration provisions of the act and requires that all household members be citizens or permanent residents. RD has also not allowed voucher applicants to appeal the determination that they do not qualify for a voucher by reason of their status as required by the act.

Third, RD issues vouchers to all residents of prepaid developments regardless of whether the prepayment is subject to use restrictions. In fact, there is no reason for RD to extend vouchers to households that remain in prepaid developments. The use restrictions require prepaying owners to continue to rent apartments to residents as of the date of prepayment as if they continued to live in a Section 515 development. The subsidy that is provided to these residents by RD vouchers does not provide the remaining residents any protection that is not already provided by the use restriction. All that the voucher does is to relieve owners from the financial burdens that the use restrictions were intended to impose on them and, thereby, discourage prepayment of their loans. The fact that RD has been issuing vouchers to households that do not need them has caused RD to run short of voucher funding over the last several years and has, as a result, deprived other households in need of vouchers from receiving them.

Lastly, the use restriction form that RD uses for developments that are prepaid subject to use restrictions authorizes the agency to lift the use restrictions when the voucher subsidy is terminated for reasons beyond the owner’s control. However, the use restrictions are a condition of the prepayment and RD vouchers were intended to provide assistance to residents and not owners. Accordingly, removing the use restrictions when voucher funding terminates violates ELIHPA.

NHLP Testifies at Hearing on Rural Housing Legislation

NHLP’s Managing Attorney Natalie Maxwell testified in front of the United States Senate Committee on Banking, Housing and Urban Development to discuss “Rural Housing Legislation.” Natalie addressed the importance of rental housing provided by USDA’s Rural Housing Service. Congress plays a crucial role in preserving rural rental housing and can ensure preservation issues are addressed by passing The Rural Housing Service Reform Act of 2023. You can read Natalie Maxwell’s full testimony here and watch the hearing here. (May 2, 2023)

Rural Housing in the Crosshairs: How USDA Affordable Housing Is Targeted for Market Rate Conversion and What Advocates Can Do to Preserve It

Kelly Owen & Scott Crain

August 2021

Sample preservation documents referenced in ABA Journal of Affordable Housing &Community Development Law, Spring 2021

- Tenant Educational Materials—footnote 27

- Notice of Informational Meeting on tenant rights at start of prepayment process

- General USDA tenants’ rights for tenants facing prepayment

- Tenant Informational Material at start of prepayment

- Tenant Information for post-prepayment where building has no Restrictive Use Covenant

- Powerpoint on Tenant Rights Post Prepayment for building with a Restrictive Use Covenant

- One-pager for non-profits on prepayment process and preserving USDA multifamily complex through nonprofit purchase—Section III

- Powerpoint for educating community and nonprofit housing agencies on USDA housing loss—Section III

- Case Study of purchase by a nonprofit: Harbor View, Friday Harbor, San Juan County, created by Charles Hitchcock, Washington State Office of Rural and Farmworker Housing (Jan. 17, 2020)—footnotes 37, 46

- USDA Environmental Justice and Civil Rights Impact Analysis Harbor Heights Apts Oak Harbor WA—footnote 29, 30